Cash Flow vs. Appreciation: The Smart Path to Real Estate Wealth

Cash Flow vs. Appreciation: The Smart Path to Real Estate Wealth

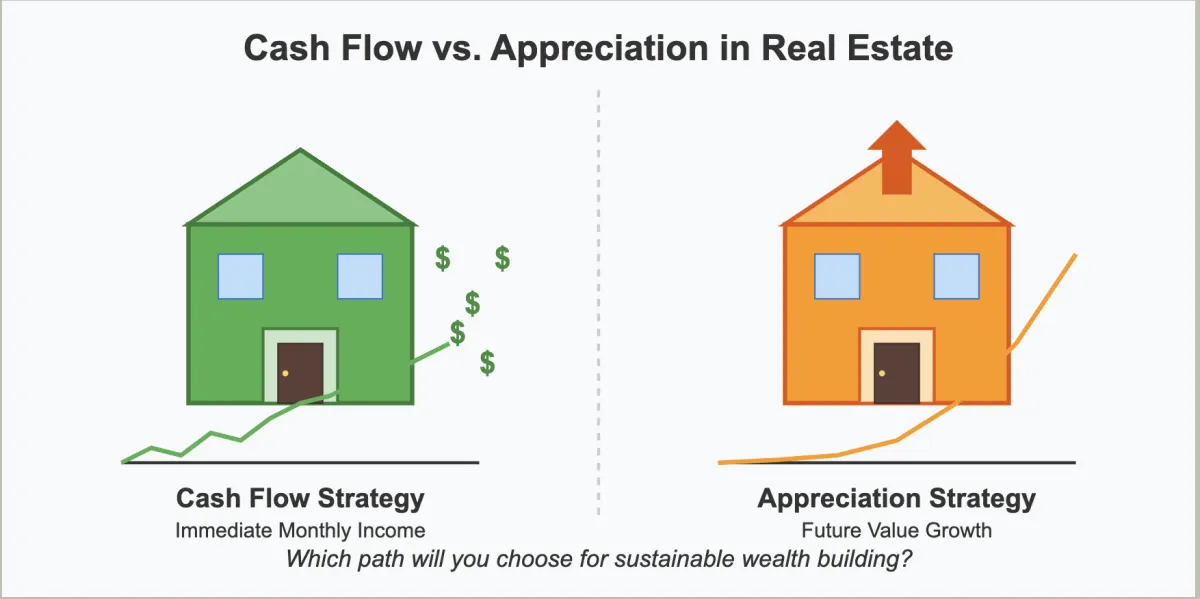

When it comes to real estate investing, there are two primary paths to building wealth: investing for cash flow or for market appreciation. As an experienced investor, I've seen many newcomers struggle with this fundamental decision, often getting swept up in the allure of appreciation while overlooking the stability of cash flow. Today, I want to break down both approaches and explain why one strategy might be significantly more prudent than the other.

The Basic Distinction

Before diving deeper, let's clarify what these two approaches entail:

Cash Flow Strategy: Purchasing properties that generate positive monthly income after all expenses (mortgage, taxes, insurance, maintenance, vacancies, etc.). The focus is on consistent, reliable returns that hit your bank account each month.

Appreciation Strategy: Buying properties in markets expected to increase in value over time, often operating at a monthly loss (negative cash flow) with the expectation of selling at a significant profit years later.

The Case for Cash Flow

Immediate Returns

With cash-flowing properties, you don't need to wait years to see a return on your investment. The money comes in monthly, providing both validation of your investment decision and capital that can be reinvested elsewhere.

Reduced Risk

When a property generates positive cash flow, you're better positioned to weather economic downturns, unexpected vacancies, or major repair costs. The property essentially pays for itself, reducing your financial exposure.

Compound Growth Potential

Monthly cash flow can be reinvested into additional properties, creating a snowball effect. Over time, this can lead to an impressive portfolio that generates substantial passive income.

Flexibility

Cash flow provides options. You can use the income to accelerate mortgage payments, invest in other assets, or supplement your lifestyle. This flexibility doesn't exist with properties that drain your resources monthly.

Objective Valuation

Cash-flowing properties can be valued based on their income (cap rate, cash-on-cash return), providing a more objective assessment than speculation about future market conditions.

The Appreciation Approach: Potential Pitfalls

Speculation by Nature

Betting on appreciation is inherently speculative. No one can predict market movements with certainty, and many factors affecting property values are beyond your control (economic conditions, neighborhood changes, regulatory shifts).

Negative Cash Flow Strain

Properties purchased primarily for appreciation often operate at a monthly loss, requiring investors to subsidize them from other income sources. This creates financial pressure and limits your ability to expand your portfolio.

Market Timing Risk

Success with appreciation-focused investing requires both buying and selling at the right time. Miss either window, and your returns can diminish dramatically or even turn negative.

Interest Rate Vulnerability

Properties that don't cash flow are particularly vulnerable to interest rate increases. When rates rise, your costs increase while your property's value might simultaneously decrease due to reduced buyer purchasing power.

Liquidity Challenges

Real estate is inherently illiquid. If market conditions deteriorate when you need to sell, you might be forced to accept a significant loss or remain trapped in a money-losing investment.

The Business Analogy

Here's perhaps the most compelling way to think about this decision: Would you buy a traditional business that loses money every month in the hopes that someday you might sell it for a profit?

Most savvy business investors would immediately reject such a proposition. Yet somehow, in real estate, many investors routinely take on properties with negative monthly returns, justifying it with appreciation expectations.

A cash-flowing property, conversely, is like a business that generates profit from day one. Even if you never sell it, you've made a successful investment that continually returns capital to your pocket.

Real-World Scenarios

Scenario 1: The Appreciation Play

John buys a $500,000 condo in a "hot" urban market, putting down 20% ($100,000). His monthly costs (mortgage, HOA, taxes, insurance) total $3,200, but the property only rents for $2,800, creating a $400 monthly deficit.

John holds for 5 years, subsidizing $24,000 from his personal funds ($400 × 60 months). The market appreciates 25%, and he sells for $625,000. After selling costs (6%), his net is approximately $587,500.

Accounting for his original investment and the monthly subsidies, John's profit is $87,500 over 5 years. That's an annualized return of about 8.3% on his initial $100,000 investment (not counting the ongoing subsidies).

Scenario 2: The Cash Flow Approach

Sarah buys a $400,000 fourplex in a stable suburban area, also putting down 20% ($80,000). Her monthly costs total $3,000, but the property generates $3,800 in rent, providing $800 in monthly cash flow.

Over 5 years, Sarah collects $48,000 in cash flow. The property appreciates more modestly at 15%, reaching $460,000. After selling costs, her net is approximately $432,400.

Sarah's total return includes both the appreciation ($32,400) and the accumulated cash flow ($48,000), totaling $80,400 on her initial $80,000 investment. That's approximately a 17.6% annualized return, with no additional capital required after the initial investment.

Why Cash Flow Wins

The cash flow approach wins for several compelling reasons:

Lower risk profile: Sarah never had to reach into her pocket to subsidize the investment.

Steady returns: She received consistent monthly income rather than banking everything on a future sale.

Reinvestment potential: Sarah could have used her monthly cash flow to accelerate mortgage payments or save for another investment.

Flexibility: If the market had turned down, Sarah could have simply held the property and continued collecting rent, while John would have faced difficult choices.

Conclusion

While both strategies have their adherents, investing for cash flow provides significantly more security, predictability, and flexibility. Appreciation should be viewed as a potential bonus to a solid cash-flowing investment, not the primary reason for purchasing a property.

Remember the business analogy: Would you buy a business that loses money every month on the hope of a future sale? For most investors, the answer should guide their real estate strategy as well.

The path to sustainable wealth in real estate isn't found in speculative market plays but in disciplined, cash-positive investments that stand on their own merits regardless of market fluctuations.

What's your real estate investment strategy? Are you prioritizing cash flow or appreciation? Share your thoughts in the comments below.